ALPHA Tracking: Can NAORIS with Massive Financing Break the Curse of VC Token Collapse?

2025-07-31 17:58

Binance Alpha will list and open trading for Naoris Protocol (NAORIS) at 20:00 (UTC+8) today. In addition, the NAORIS/USDT perpetual contract will be launched at 20:30, with a maximum leverage of 50x. All eligible Binance users will receive exclusive token airdrops from Binance. The NAORIS token has a relatively niche concept, but its financing amount ranks among the top in ALPHA tokens. In recent years, VC-backed tokens have frequently collapsed. Can NAORIS break this curse?

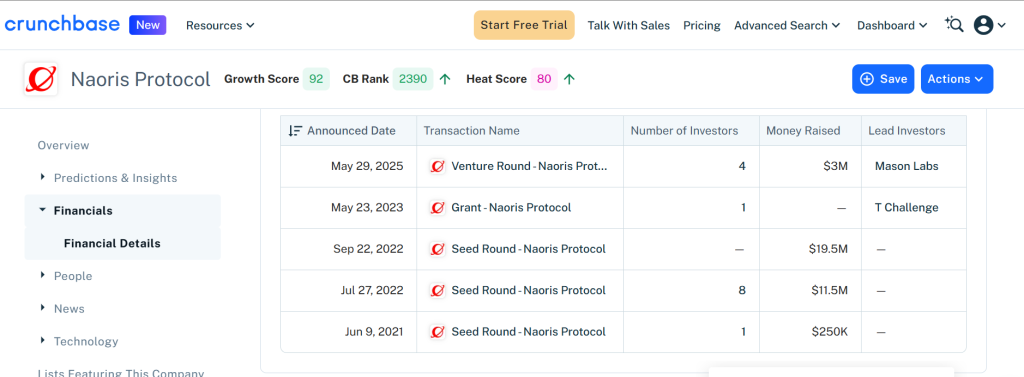

NAORIS Financing Overview

Naoris Protocol has raised a total of $34.3 million across over 5 rounds of financing.

Its latest financing round was on May 29, 2025. According to Crunchbase, the probability of another financing round within the next six months is 90%.

Among Binance Alpha tokens, a multi-million-dollar financing amount is already among the highest, considering that few tokens listed on ALPHA have a market value of over $10 million, let alone financing. Institutional investors hold 16.2% of the tokens, corresponding to an average fully diluted valuation (FDV) of approximately $200 million, with an average institutional cost of $0.05 per token.

Introduction to Naoris Project

Naoris Protocol is a decentralized security network service provider that protects the digital world using quantum-resistant computing capabilities, real-time system verification, and a scalable decentralized trust network across the internet. As an infrastructure project, it is relatively niche with few competitors, giving it unique characteristics.

Current testnet data: 100,503,620 post-quantum transactions; 3,348,471 wallets; 1,065,154 security nodes; 474,920,371 threats mitigated.

Token Economic Model

Total supply: 4 billion tokens, with an initial circulation of approximately 11%.

Token distribution: 16.23% to VC, 34% to the community, 20% to the team, 14.3% to the treasury, 13% to the ecosystem, and 5% to liquidity.

Public sale price: $0.125, corresponding to an FDV of $500 million, with 100% unlock upon listing.

Based on community-sourced information:

- Project-side holdings: 3% (community) + 5% (liquidity) + 1% (ecosystem) + 1% (treasury) = 10%

- Long-term distribution: 1% (community)

- Initial selling pressure: 4% (community)

Market Popularity

- X (Twitter) followers: 310K, with average views of 30,000–50,000.

- Discord members: 170K, with an average of 7,000 online users.

- Telegram members: 45K, with an average of 1,300 online users.

Overall community popularity is not high. However, the token will be listed on multiple exchanges simultaneously, including Binance Alpha, Binance Futures, Gate, and MEXC, ensuring sufficient market liquidity.

Summary

Naoris, as an infrastructure service, has limited user engagement, resulting in low community 热度. Its path for future user expansion is also unclear. However, the project’s strengths lie in its massive financing, unlaunched mainnet, minimal airdrop tokens, low initial circulation, and sufficient liquidity from multi-exchange listings.

Such tokens may exhibit strong market manipulation and high volatility in the secondary market. Short-term trends will depend on market sentiment, while mid-to-long-term value could be supported by its unique concept and financing-backed stability. New tokens carry high risks; do your own research (DYOR).

免责声明:含第三方意见,不构成财务建议