The Chinese Gang Behind the Trump Crypto Project

2025-09-02 11:33

Image source: "Water Margin (1998)"

In 298 BC, the state of Zhao had three thousand guests under the protection of Lord Pingyuan. Among them, Mao Sui could debate with scholars in the court of Chu and secure a chance for Zhao.

More than two thousand years later, on September 1, 2025, a token named WLFI launched on global trading platforms. The Chinese capital network across the Pacific is supporting the digital empire of the U.S. presidential family.

Behind this project valued at 40 billion USD, there are modern "guests." There are a Chinese billionaire who invested 75 million USD, a platform founder seeking presidential pardon, a stablecoin expert focusing on the Asian market, and an Eastern force that can elevate the Trump family's wealth or bring it to ruin overnight.

When the wealth of American political families intertwines deeply with Eastern capital, and when China influences the global crypto landscape through the Hong Kong market, a new geopolitical game is unfolding.

Binance, the Central Node of the Chinese Network

To understand the influence of the Chinese community in the WLFI project, one must start with Binance, the world's largest cryptocurrency exchange. This platform founded by Chinese entrepreneurs has now become the nerve center of the entire Chinese crypto network.

Binance accounts for about 30% of global cryptocurrency trading volume, with daily turnover exceeding 20 billion USD. Its penetration rate in the Asian market exceeds 60%, meaning most fund flows go through its system. This control makes Binance's position in the Chinese network close to a monopoly.

The founder of Binance, Zhao Changpeng (CZ), was once sentenced to four months in prison for violating anti-money laundering regulations. According to insiders, CZ is seeking a pardon from Trump through various channels. This rumor is not baseless. Trump granted clemency to several financial criminals during his first term, including his former campaign manager Paul Manafort.

For CZ, a four-month sentence may not be long, but for a business empire controlling thousands of billions of dollars in assets, whether the founder is free is crucial to the stability of the entire system.

On March 13, 2025, the Wall Street Journal reported that the Trump family was negotiating to acquire a large stake in Binance US, but CZ strongly denied it. Subsequently, Bloomberg also stated that they were very sure that some of the information came from reliable sources, citing statements from four anonymous insiders, including that both sides were about to launch a stablecoin, which is now seen as USD1.

Despite strong denials from both sides, the interaction between USD1 and Binance still reflects their close relationship.

In late April, WLFI and CZ's official social media accounts released photos of the three co-founders of WLFI meeting with CZ in Abu Dhabi, stating that the topics discussed included expanding global adoption, setting new standards, and taking cryptocurrencies to a new level.

At the beginning of May, Eric Trump revealed during the Token2049 event that MGX, an Abu Dhabi investment company, invested 2 billion USD in Binance, using USD1 stablecoin as payment. Normally, this money should have been quickly converted into USD, but Binance kept 1.9 billion USD in its own address, directly becoming the largest holder of USD1, accounting for 92.8% of the total supply.

This operation directly pushed the market value of USD1 from 130 million USD to 2.1 billion USD. If this amount is excluded, the actual circulating supply of USD1 is around 100 million USD. The inflated data on the surface became the key support for WLFI's 40 billion USD valuation. Such manipulation in traditional financial markets might constitute market manipulation, but in the relatively loosely regulated crypto field, it has become a common practice.

That month, WLFI officially published an X post clearly supporting the cultural mascot Meme coin $B (BUILDon) in the BNB Chain ecosystem, and purchased approximately 25,000 USD worth of $B. The news caused a stir in the market, with the token price surging and the market cap reaching over 300 million USD.

The public endorsement of $B by WLFI is not just a small investment. For Binance, Meme coins are both amplifiers of community sentiment and natural entry points for traffic. The attention generated by promoting $B quickly fed back into the narrative of USD1. It no longer just a newly launched stablecoin, but was packaged into a larger story of "ecosystem expansion" and "community building."

In this system, Binance is using familiar techniques to tie the promotion of stablecoins and the frenzy of the Meme market together. First, use Meme coins to attract attention, then let USD1 take on the role of "base currency" within it. The hype becomes a strategy, and the heat becomes a tool for market education. Therefore, the ecological promotion of USD1 has gained far more exposure than its actual scale in a short time.

The Gathering of Chinese Guests

Outside of Binance, there are also a number of technical projects that have gathered, and their collaboration with WLFI has made the entire ecosystem more tightly connected. These seemingly independent companies actually weave together a precise Chinese capital network.

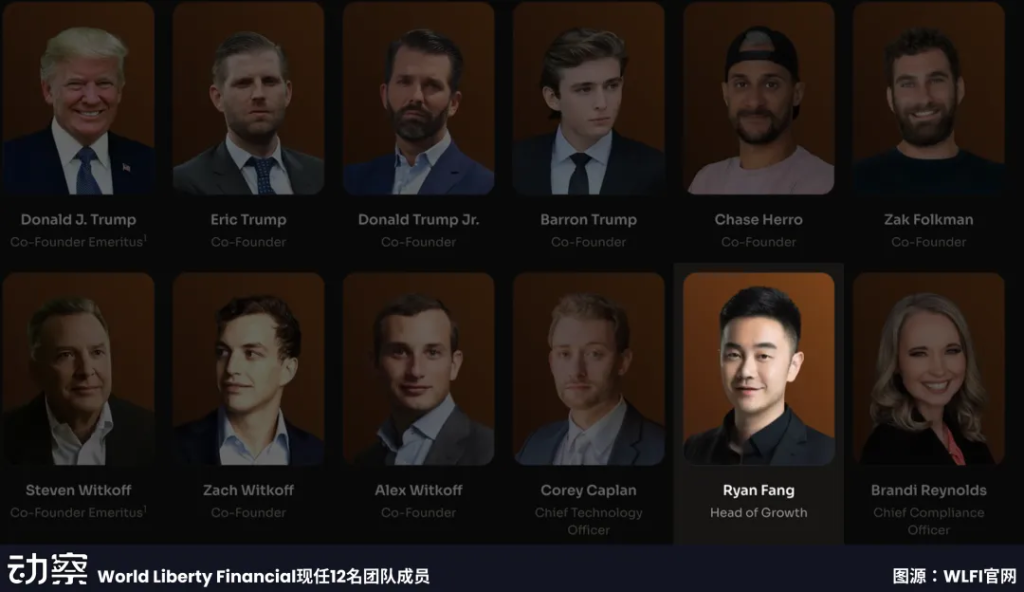

Ryan Fang: The Only Chinese Member of the Current Team, the Trusted Project Operator of Binance

In the Chinese technical network of WLFI, Ryan Fang holds an important position, and he is also the only Chinese member of the current team. At the same time, Ankr is recognized as "Binance's affiliated company." In addition to BSC nodes and liquid staking services, well-known BSC (now BNBChain) ecosystem projects such as BounceBit, Auction, and Neura were all created by the Ankr team.

Ryan is the co-founder and COO of Ankr, and has also participated in creating PrimeBlock and Tomo. He worked at Morgan Stanley early on, then entered the private equity industry, accumulating experience in traditional finance. These backgrounds allowed him to better understand the combination of funds and technology in the blockchain world.

Ankr, as a leading blockchain infrastructure service provider globally, provides RPC nodes and cross-chain tools for multiple projects, including Binance's BSC chain. The circulation of USD1 depends on these nodes to complete transaction confirmations and network stability. Through Ankr's cross-chain services, USD1 can freely transfer across multiple chains such as Ethereum, BNB Chain, and Polygon.

In WLFI, Ankr has another role. Its Liquid Staking product allows USD1 to be staked and generate returns, transforming this token from a simple payment tool into an asset with financial attributes. Users gain returns while contributing liquidity to the entire ecosystem.

Ankr has provided services to over eight thousand blockchain projects. These existing customer relationships form a natural channel for USD1 to expand outward. Stablecoins need to enter new application scenarios, which can be achieved through Ankr's network for distribution.

As a modern "guest," Ryan Fang embeds a newly issued stablecoin into the daily operations of the global crypto market through infrastructure.

Rich Teo: The Foxconn Factory of Stablecoins

Richmond Teo, co-founder of Paxos, is also involved in the WLFI project.

Paxos was once the most important stablecoin partner of Binance. Its BUSD was long the main stablecoin of Binance, with a market value exceeding 20 billion USD.

During 2022, Paxos became one of the main stablecoin issuers and technology providers globally. Its co-founder Zhang Qianhao (Rich Teo) had a good personal relationship with Binance CEO CZ, and there was even a scandal in the crypto circle, causing CZ to rarely post a Weibo statement to deny it.

By 2023, U.S. regulatory authorities required Paxos to stop issuing BUSD, and the company suddenly fell from the peak, entering a long period of silence. The industry generally believed that Paxos had lost its competitiveness.

Of course, with the advancement of U.S. stablecoin legislation, Paxos has once again become one of the teams that benefited from regulatory policies. Stablecoins like PayPal's PYUSD and DBS Bank's USDG are also issued by Paxos.

Teo was responsible for Asia market operations at Paxos, and was very familiar with the compliance paths of stablecoins under different regulatory systems. The shutdown of BUSD was a heavy blow for him, but it also forced him to accumulate experience in dealing with regulation and market contraction. For WLFI, this experience is particularly important. The issuance and circulation of USD1 also face regulatory uncertainties.

Teo's appearance is not just a personal return, but also means that Paxos is trying to find an opportunity to re-enter the stablecoin market through WLFI. This relationship makes USD1 easier to be accepted in the market, and also gives Binance more assurance for WLFI. For the entire Chinese network, Teo's joining means that a key part of compliance and regulation has been replenished again.

DWF Labs: Key Liquidity Provider

In the Chinese network of WLFI, DWF Labs is a key liquidity provider.

This company is headquartered in the UAE and has grown into one of the largest high-frequency cryptocurrency trading entities in the world in three years, managing over 2 billion USD in assets and providing market-making for hundreds of projects, many of which have developed into top projects with a market value exceeding 1 billion USD.

In the BNB Chain ecosystem, DWF Labs holds a prominent position. It maintains a close relationship with Binance, playing a core role in liquidity support for on-chain projects and directly participating in ecosystem development. As a top market maker, DWF Labs collaborates with major global exchanges, able to secure listing channels for new projects and provide support in the face of regulation.

For WLFI, DWF Labs' involvement goes beyond a simple gesture. It has invested 25 million USD, occupying an important share of the Chinese capital investment, and is expected to become the official market maker of WLFI, responsible for maintaining price stability and market liquidity. Once this role is taken on, DWF Labs will be deeply integrated with WLFI, meaning it will have a direct connection with the Trump family's digital asset plans.

In addition, its DeFi project Falcon Finance has also received token investments from WFLI and has immediately accepted USD1 as collateral for the protocol.

Sun Yuchen's "Critical Rescue"

In this Chinese network, Sun Yuchen plays a critical "firefighter" role. In October 2024, when the WLFI project sales were poor, only raising 2.7 million USD, and seemed to be doomed, Sun Yuchen's investment arrived like a blessing, saving this almost failed project.

This investment came at an incredibly precise timing. It occurred in the third week after Trump's election victory, at a key moment when the global crypto market was celebrating due to policy expectations. At that time, Bitcoin prices soared from 70,000 USD to 100,000 USD, and the total market value of the crypto market increased by over 1 trillion USD.

As the founder of Tron, Sun Yuchen understands the political value of this investment. Tron is the third-largest blockchain network globally, behind Ethereum and BNB Chain, with over 200 million users and 100 billion USD in on-chain assets.

Sun Yuchen has a deep relationship with Binance founder CZ. Sun Yuchen publicly referred to CZ as a "good teacher and friend," and their friendship goes beyond mere business cooperation. When CZ faced legal issues due to anti-money laundering violations, Sun Yuchen was one of the few industry leaders who publicly expressed support, which attracted widespread attention in the industry. This mutual support relationship gives Sun Yuchen significant influence within the Chinese network.

The Trump family's stake in the WLFI project is approximately 400 million USD, accounting for about 40% of their total wealth. This highly concentrated investment strategy has made the Trump family's desire for the project's success unprecedentedly high.

Afterward, Sun Yuchen obtained the position of WLFI advisor and emphasized the importance of financial freedom and USD1 in public appearances with Eric Trump. More importantly, he added another 45 million USD investment, bringing his total investment to 75 million USD, further binding himself to WLFI's interests.

Eric Trump's Pilgrimage to Hong Kong, WLFI's Strategic Chessboard

August 29, 2025, Hong Kong Convention and Exhibition Centre.

In the main hall of the BitcoinAsia conference, crypto investors from across Asia gathered. When Eric Trump stepped onto the stage, the audience gave a warm round of applause. This son of the president thanked Hong Kong for the enthusiastic welcome, calling the atmosphere "like a rock concert."

Eric Trump expressed a strong bullish attitude towards Bitcoin, confidently predicting that the price of Bitcoin would reach 1 million USD, and possibly even higher. He advised the audience to buy now and hold for the long term, viewing volatility as a friend.

Behind WLFI lies a larger strategic chessboard.

As an international financial center, Hong Kong has formed a relatively complete regulatory framework and licensed trading system for cryptocurrencies. A large amount of Asian capital enters the global market through Hong Kong, and the flow of these funds is enough to influence prices.

The Trump family has nearly half of its wealth invested in cryptocurrencies, equivalent to entrusting its fate to a market it cannot fully control. From the distribution of on-chain addresses, the proportion of Asian investors is very high, especially Hong Kong and Singapore.

This shift in power is also reflected in the policy aspect. The Trump administration has shown rare caution towards China: the 60% tariff promised during the campaign did not materialize; regarding crypto regulation, the new SEC chair Paul Atkins stated that they would maintain a more open stance towards projects from Asia; the U.S. Treasury also canceled sanctions against several Chinese crypto companies, leaving room for cooperation.

From Sun Yuchen's 75 million USD investment to Binance's platform support; from Paxos' compliance and technology to DWF Labs' market services; from Ryan Fang's infrastructure layout to the aggregation of Hong Kong capital, it can be seen that a trans-Pacific Chinese network is providing support for the Trump family through the "digital guests" way.

The characteristics of this guest network are no different from those of two thousand years ago. Some people provide money, some provide labor, and some provide technology and channels. The difference is that today's stage is not in the court of Chu, but on the blockchain market. The emergence of digital guests means that Chinese capital and technology have occupied an irreplaceable position in the new power structure.

At the Hong Kong event, Eric Trump's comments on China were particularly noteworthy. Eric Trump said that the United States and China may know more about digital currencies than any other country in the world. He called China a "powerful force" in developing cryptocurrencies.

At this historic moment, we see the new rules of the power game. When the son of the president stands on the stage in Hong Kong, expressing respect to Asian investors and praising China's strength in the field of digital currencies, the traditional boundaries of geopolitics are being redefined.

Chinese capital and technology are no longer just peripheral sources of funds, but have become "digital guests" entering the core, playing a substantial role in this transnational game.

The applause from the audience continued for a long time, the wheels of history rolled forward, and we are witnessing the beginning of a new era.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service