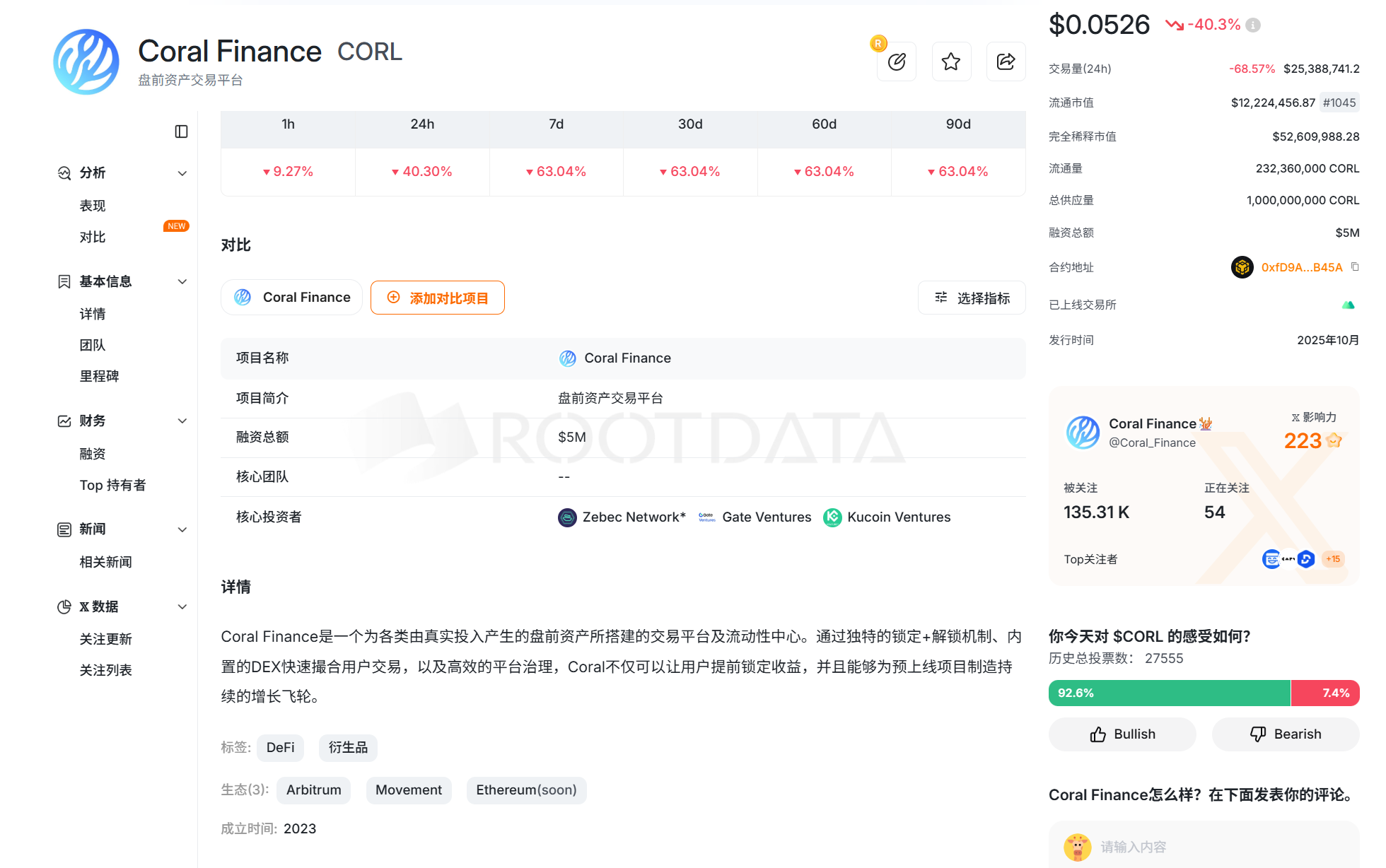

10/12 Binance ALPHA New Coin Research: $CORL (Coral Finance) Comprehensive Network Analysis

2025-10-12 18:59

This project will only be listed on Binance ALPHA, Binance Alpha trading time is 19:00, Gate spot trading time is 21:00, institutional financing of 5 million USD, projects launched on ALPHA over the weekend are generally not good, and belong to DeFi pre-launch projects in the Movement ecosystem, with average popularity. Below we will conduct a detailed analysis of $CORL (Coral Finance):

I. Investment Research Conclusion (Quick Summary)

Project Summary: DeFi project in the Movement ecosystem, average popularity, most functions not yet launched, launched on ALPHA over the weekend

Simple Introduction:

Coral Finance is a pre-launch asset trading platform and liquidity hub (tokens/NFTs/whitelist). Through a unique locking and unlocking mechanism, an integrated DEX for quick trade matching, and efficient platform governance, Coral not only allows users to lock in earnings in advance, but also provides liquidity solutions before TGE.

Valuation Analysis: Total token supply 1 billion, circulating supply 23.2%, project team 22%, unknown selling pressure (Binance ALPHA 0.8%, airdrop not yet queried)

1) First round: April 2023, 1.5 million USD

2) Second round: August 2023, 0.5 million USD

3) Angel round: March 2025, 3 million USD

Total financing, 5 million USD, allocated tokens 10%, corresponding to VC cost price 0.05, corresponding to FDV 50 million USD

Estimated Comprehensive Valuation: Institutional cost 0.05, Movement ecosystem has little popularity, and the token is almost worthless, the project has almost no functions, the recent new ALPHA project has a valuation of 70 million, and the ALPHA market is bearish, the valuation is basically close to the VC cost price.

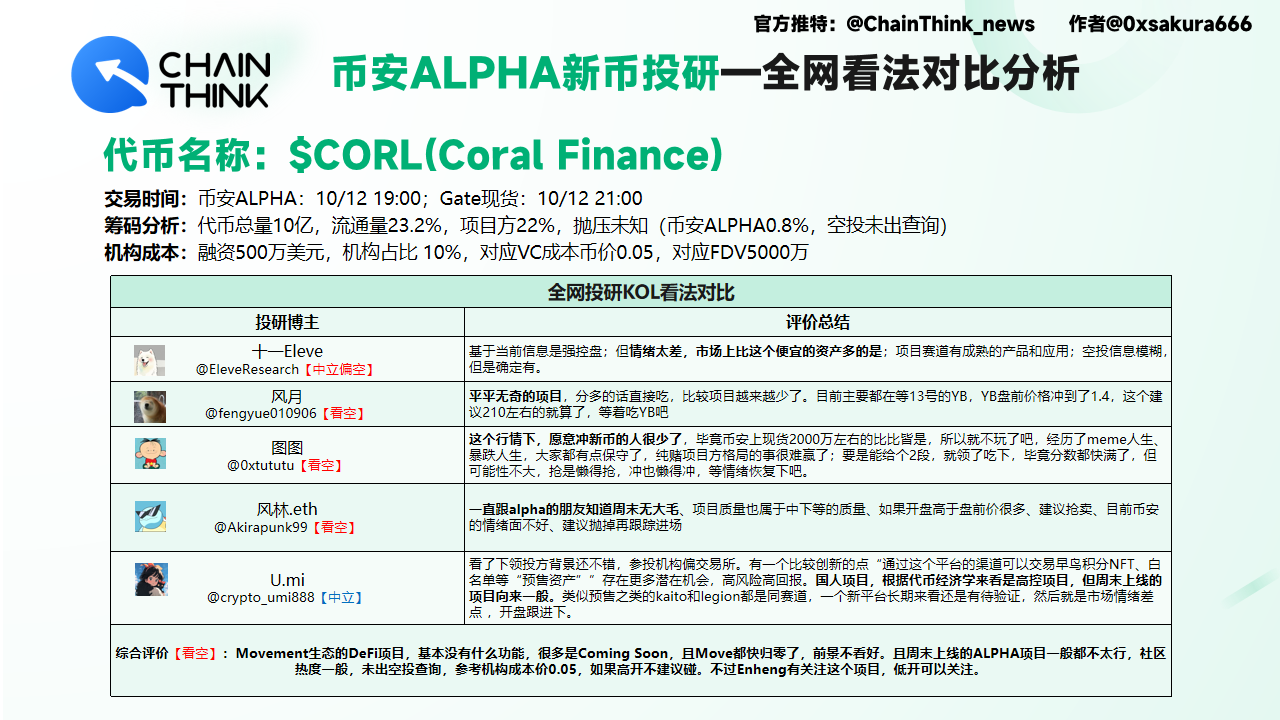

Comprehensive Evaluation [Bearish]: Movement ecosystem DeFi project, said to be pre-launch, but when I entered the official website, there was basically nothing functional, many were Coming Soon, and Movement is almost worthless, prospects are not optimistic. Projects launched on ALPHA over the weekend are generally not good, community popularity is average, airdrop not yet queried, referring to institutional cost price 0.05, if it opens high, it is not recommended to touch. However, Enheng is paying attention to this project, and if it opens low, it can be watched.

II. Summary of Other KOLs' Opinions: 5 people were surveyed, 4 were bearish, 1 was neutral

1) Eleven [Neutral to Bearish]

@EleveResearch:

Based on current information, it's strongly controlled; however, the sentiment is too poor, there are many cheaper assets in the market; the project's sector has mature products and applications; airdrop information is vague, but it is confirmed to exist.

2) Fengyue [Bearish]

@fengyue010906:

Average project, if it's split, just take it, as projects are getting fewer. Currently, everyone is waiting for YB on the 13th, YB pre-launch price reached 1.4, this one is suggested to be around 210, wait for YB instead.

3) Tutu [Bearish]

@0xtututu:

In this market, few people are willing to rush new coins, since there are many with spot volumes of around 20 million on Binance, so I won't play. After experiencing meme life and crash life, people have become more conservative. It's hard to win by betting on the project team's vision. If it could give a second round, I would take it, since the scores are almost full, but it's unlikely. It's not worth the effort to grab or rush, better to be cautious and wait for the mood to recover.

4) Finglin.eth [Bearish]

@Akirapunk99

Friends who follow ALPHA know that there's no big news on weekends, and the quality of the project is generally average. If the opening price is much higher than the pre-launch price, it's recommended to sell quickly. The current sentiment on Binance is not good, it's recommended to sell and track for entry.

5) U.mi [Neutral]

@crypto_umi888

Looking at the lead investors' background, it's quite good, and the participating institutions are mostly exchanges. There is one innovative point: "Through this platform, early bird NFTs, whitelist, etc., can be traded as pre-sale assets," which may offer more potential opportunities, high risk and high return. A Chinese project, based on token economics, it's a highly controlled project, but projects launched on weekends are generally not good. Similar pre-sale projects like Kaito and Legion are in the same sector. A new platform will need time to prove itself in the long run. Also, the market sentiment is slightly weak, so it's recommended to follow up on the opening.

Risk Warning: The above content is based on network material analysis and is for project research discussion purposes only, not to be used as investment advice.

Author: Sakura, ChainThink

Editor: Evan, ChainThink

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service