Market Analysis: Could Ethereum's 10th Anniversary Be a Trap for Whales to Unload Their Holdings?

2025-07-30 18:17

Today marks the birthday of Ethereum, the world's second-largest blockchain project. Over its 10-year journey, ETH has surged from $0.3 to over $4,000, a more than 13,000-fold increase, ranking it among the 28th largest global assets and making history! Tonight, Ethereum founder Vitalik will also appear in a 10th-anniversary live stream to revisit Ethereum's history.

Turning to the current market, the community's calls for ETH to break above $4,000 are growing louder, but ETH has shown signs of weakness. Could this 10th anniversary trigger a crisis of large-scale sell-offs?

Warning Signs in the Crypto Market

The broader market remains in an uptrend recently. While many altcoins have declined, BTC and ETH stay steady, with unusually active capital flows. There are still frequent opportunities for quick gains: OMNI surged 200% in a day, CFX spiked 40% in a short time, and PUMP jumped 20% within an hour.

However, there are clear signs of divergence and institutional capital withdrawal:

- Beyond ETH, the leading altcoins this cycle have focused on XRP and PENGU, which have been driving the market but recently showed top signals. Meanwhile, ENA, CRV, and other coins that led gains last week and were expected to take the baton have pulled back after rapid rises. Currently, capital lacks new narrative-driven leaders.

- Only BNB, along with a host of BNB ecosystem tokens, is seeing short-term speculative trading (a "hit-and-run" style by hot money), with no visible institutional support.

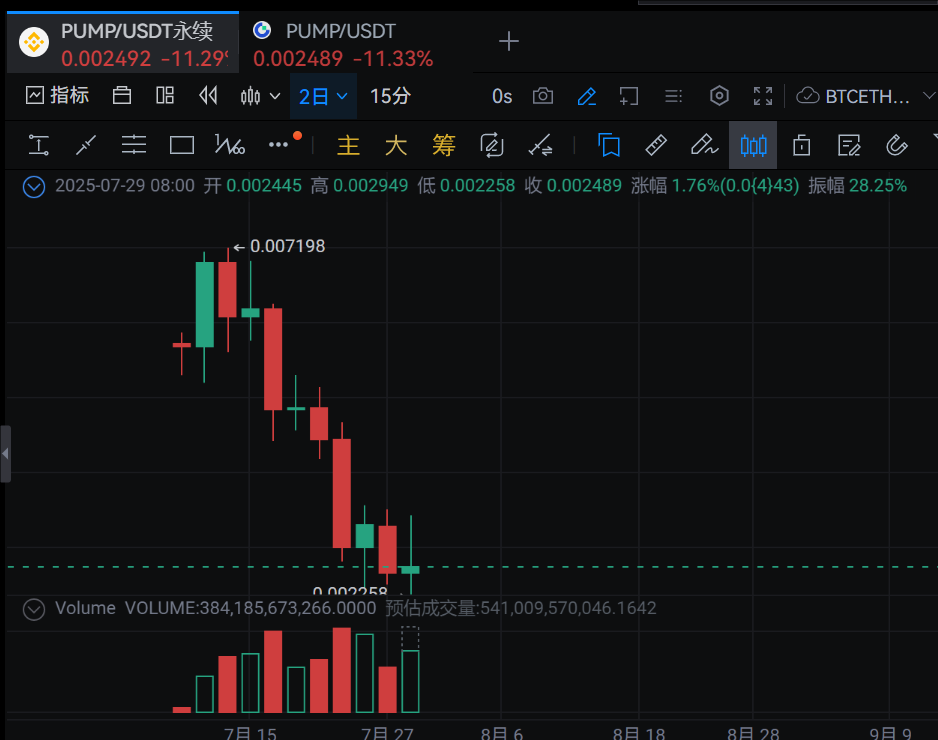

- Recently listed tokens have hit yearly highs, but many have collapsed: PUMP, which listed two weeks ago amid obvious pumping, has plummeted over 60%; TREE, a new token listed yesterday, has dropped 50% from its opening price. Additionally, major L2 project Linea is set to issue its token, while Opensea, Polymarket, Xpl, and others are queuing for listings—all will continue to drain liquidity from the market.

A rising number of post-listing breakouts for new tokens could act as a catalyst for a market crash.

Hidden Risks in the U.S. Stock Earnings Season

Starting Wednesday, the market will face a series of critical tests: the U.S. will release Q2 GDP data, followed hours later by the Federal Reserve's interest rate decision; tech giants like Microsoft, Meta, Apple, and Amazon will release earnings after hours from Wednesday to Thursday; and the highly anticipated U.S. July non-farm payroll report will come out on Friday.

Any of these events could trigger market volatility. With U.S. stocks having rebounded sharply from their April lows and valuations now elevated, this "super week" is seen as a severe test for the market.

Jones Trading analyst Mike O’Rourke believes this week "may prove to be the most critical of the year," with its outcomes set to test Wall Street's confidence.

Technically, many U.S. stocks are showing worrying trends, with risks of breaking down from their tops.

On-Chain Data

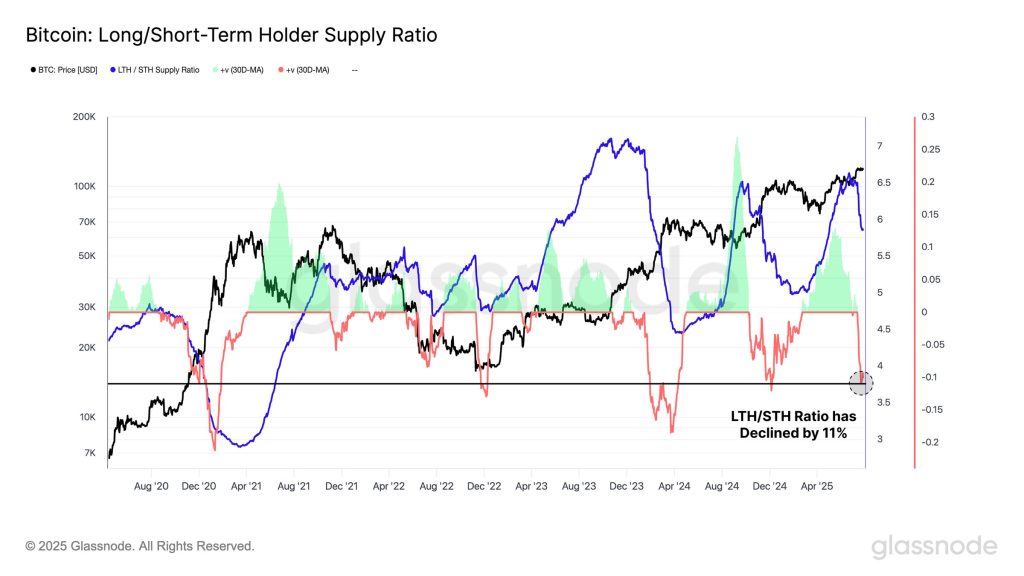

According to Glassnode, the 30-day ratio of long-term holder to short-term holder supply (LTH/STH) for Bitcoin has dropped 11%, indicating capital continues to flow into the circulating market. Long-term holders have been gradually selling off—while this typically happens earlier in the cycle and doesn't mean an immediate market top, it does signal significant consolidation pressure.

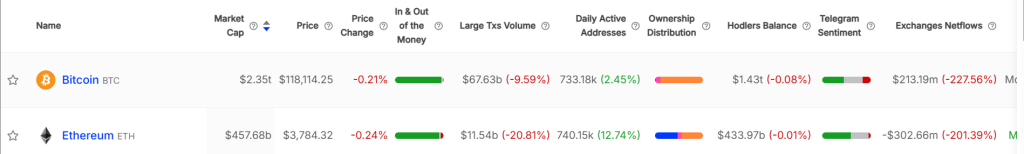

Additionally, over 90% of BTC and ETH addresses are in profit: only 0.17% of BTC addresses are at a loss, and around 5% for ETH, creating massive pressure for profit-taking.

Technical Trends

ETH shows clear risk signals: daily and double-daily RSI are severely overbought with obvious divergence. The 12-hour chart has tested the middle Bollinger Band multiple times, growing weaker, increasing the probability of a breakdown. A drop below this band would mean ETH has lost a key support level held throughout the current rally, potentially leading to a prolonged correction. In the short term, the $3,650–$3,700 range may hold temporarily, but a break below $3,650 could trigger a cascading drop to $3,300–$3,500. If ETH fails to firmly break above $4,000 in the next 1–2 weeks, downward adjustment expectations will persist.

Similarly, BTC has rebounded to around $120,000 (near strong resistance) after we called a bottom at $115,000 last week, facing a new directional choice. A breakdown below $116,500 could test the $112,000–$114,000 range.