Crypto Stock Analysis: YHC and MFH, Crypto-related U.S. Stocks, Plummet 80% in Succession—Is the Crypto-Stock Narrative Collapsing?

2025-07-28 17:51

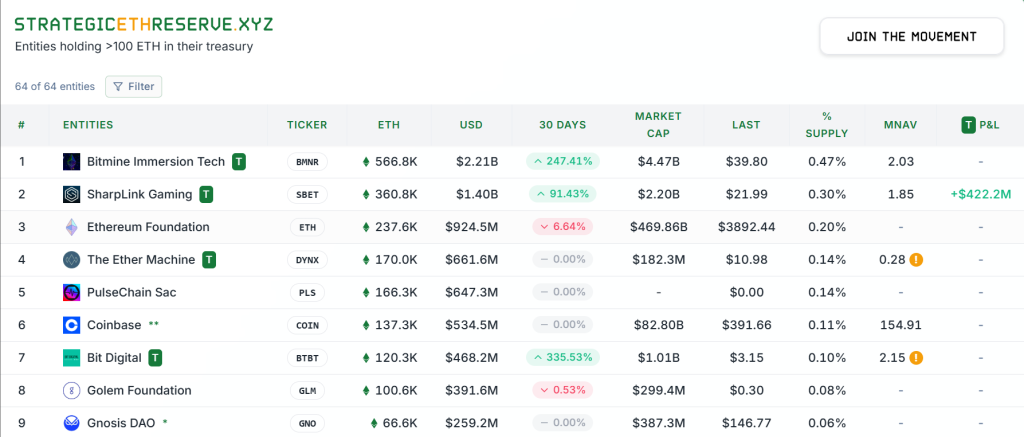

If we talk about the most wealth-generating sector this year, crypto stocks are undoubtedly among the brightest stars. In May, crypto stocks saw an accelerated rally: leading crypto-linked stocks tied to Ethereum, Solana, Tron, etc., surged dozens of times within 1-2 weeks. Star stocks like SBET, UPXI, and SRM became hot topics in the market. However, two crypto-related U.S. stocks, YHC and MFH, recently plummeted 70-80% suddenly. What caused this? Does the collapse of individual stocks signal a crisis in the crypto-stock narrative?

The Plummet Crisis and Its Causes

Let’s start with YHC, a Bitcoin concept stock. It rose steadily from around $1.2 on June 27 to $11, then began crashing on July 17, falling to $1.79 within three trading days—a plunge of 83% from its peak.

MFH’s performance was even more shocking. On July 21, it opened at $6 and crashed directly to $1.3, plummeting over 70% in a single day, and has since slightly recovered to $2.7.

What caused these sharp short-term declines?

It’s worth noting that the U.S. stock market, as a highly volatile market, has never lacked profit opportunities. However, due to the absence of price limits, plunges are common among small and mid-cap stocks.

YHC, or LQR House, mainly engages in developing premium limited-edition spirits brands, establishing exclusive wine clubs, and conducting internal and external brand marketing through an exclusive agreement with a U.S. e-commerce portal. It went public in August 2023, but after a brief consolidation, its stock price plummeted from $90 to around $1, only reversing its trend this year after announcing a Bitcoin-focused strategy.

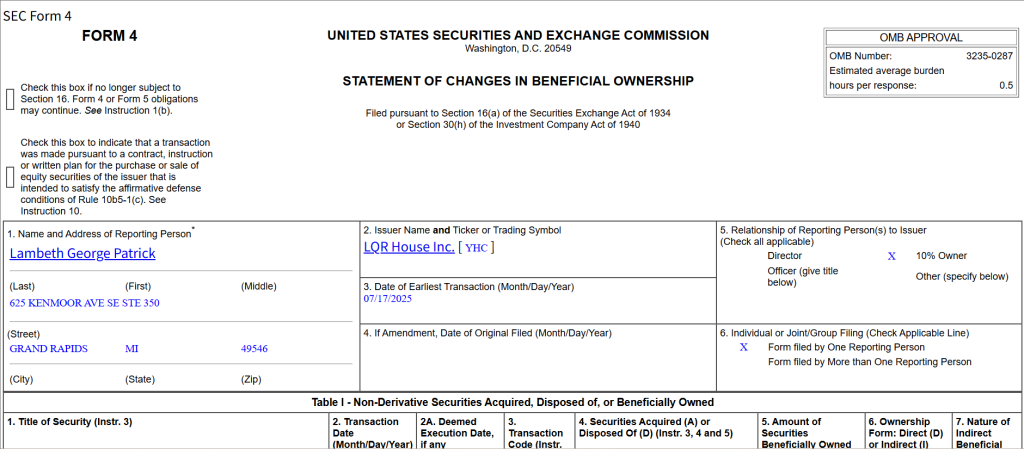

As a small-cap stock, YHC inherently carries high volatility risks, with a current market capitalization of only $1.9 million. Additionally, after a continuous surge, on July 21, SEC filings revealed that George Patrick Lambeth, a 10% owner, sold 180,000 common shares of LQR House (YHC) for $546,318. This was a classic case of major shareholders dumping shares at high prices, trapping numerous chasing investors at the peak.

MFH, or Mercurity Fintech, is also a Chinese concept stock.

MFH has a deeper layout in the blockchain field and a certain fundamental foundation. After the market close on June 27, Mercurity Fintech was officially added to the Russell 2000 Index, reflecting recognition from the capital market.

On July 21, the company disclosed a series of heavyweight news. It first announced a $200 million equity credit facility agreement with Solana Ventures Ltd. to launch a digital asset treasury strategy based on the Solana blockchain, leading to a brief rally at the opening. However, subsequent news came as a bolt from the blue: the company stated it had priced a registered direct offering of approximately 12.5 million shares and warrants of equal quantity, with the shares priced at $3.50 each and the warrants exercisable at $3.50 for five years. With the stock price above $5 at the time, the market crashed, with panic selling pushing it to around $1. MFH’s extreme plunge partly involved irrational selling.

The Long-Term Trend of Crypto Stocks

MicroStrategy’s stock has risen from $14 to $413 in three years, a surge of over 3,150%, far outperforming Bitcoin and most highly volatile altcoins. MSTR has become a benchmark for crypto stocks, with a market capitalization exceeding $110 billion—surpassing even Ethereum’s current market cap of over $300 billion, making it a behemoth in the crypto space by comparison.

Moreover, during the deep bear market of 2022, MicroStrategy withstood market tests. Even as it continued accumulating Bitcoin when its price was $60,000, and later fell to over $15,000, the company’s financial position did not collapse. This indirectly reflects MSTR’s prudent financing and accumulation strategy, proving that the crypto-stock model can be sustainable.

However, aside from MSTR, no other crypto-stock leader has emerged to rival it. Many companies are hailed as the "MSTR of Ethereum, Solana, or other major coins," but they have not weathered bear markets and remain billions in market cap—far behind MSTR. Thus, in the long run, attention should focus on which company can survive a bear market to become a true crypto-stock leader tied to Ethereum or other major cryptocurrencies, presenting significant opportunities.

The plummets of MFH and YHC are essentially growing pains in the integration of cryptocurrencies and traditional finance, not signals of a narrative collapse. The market is in a critical transition from concept speculation to value-driven growth. Enterprises with technological moats, regulatory advantages, or real cash flows will gain a stronger position after market consolidation. For example, Coinbase’s Base network has a TVL exceeding $14.9 billion, and its positioning as "crypto financial infrastructure" has gained market recognition.

How to Navigate High Volatility in Crypto-Related U.S. Stocks

Nevertheless, the collapses of MFH and YHC should serve as a warning to investors. After all, a single-day 70% drop in holdings would be catastrophic for heavy investors. Therefore, the primary principle of investing should be setting stop-losses to ensure losses remain acceptable.

Investors should vigilant two types of risks: first, "hype-driven" enterprises lacking substantial business support; second, high-leverage strategies overly dependent on crypto asset price fluctuations.

Author: ChainThink, Aaron

Reviewer: ChainThink, Charlie